Recurring, automated revenue versus Remaining Pay

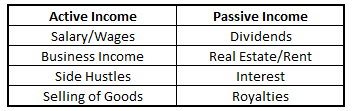

Pay alludes to cash an individual or business element gets to offer support while making a venture. Automated revenue and remaining pay are two classifications of pay. Albeit these terms are frequently utilized reciprocally, they are on a very basic level unique. While remaining pay might be detached, passive income isn’t lingering all the time. Recurring, automated revenue is cash procured from a venture with almost no continuous exertion. Remaining pay isn’t precisely a sort of pay yet a computation deciding how much optional cash an individual or element can spend subsequent to taking care of their bills and meeting their monetary commitments.

Automated revenue

- Automated revenue is procured with almost no work, and people and organizations frequently make it consistently, for example, a venture or shared (P2P) loaning. The Inside Income Administration (IRS) recognizes it from brought-in pay as cash procured from an element with which you have no immediate contribution. Assuming that a singular’s recurring, automated revenue is adequately large, it can save their chance to do different things other than work.

- Furthermore, despite the fact that it could be unsafe while laying out the instrument for recurring, automated revenue, it likewise offers expanding levels of monetary security. Automated revenue can give critical security in the event that it gives consistent income since it’s not associated with your time. On the off chance that it’s adequately not to stop your normal everyday employment, it’s as yet good to have an extra pay source to enhance what you acquire from working.

- You might try and have superior personal satisfaction by moving a greater amount of your yearly pay to a latent source, particularly in the event that you have a ton of obligation or a ward becomes ill. One illustration of recurring, automated revenue is the benefit acknowledged from an investment property claimed by financial backers who are not effectively engaged with overseeing it. Another model is a profit-delivering stock that pays a yearly rate. While a financial backer should buy the stock to understand the automated revenue, no other exertion is required.

Exceptional Contemplations

At times recurring, automated revenue and leftover pay are alluded to as exactly the same thing, the cash you acquire with practically no work. In any case, they are not exchangeable on the grounds that they can mean totally different things. For instance, on the off chance that you own an independent venture, your lingering pay is determined by the benefit you make subsequent to covering your bills as a whole. As an individual, lingering pay is the amount you have extra after you pay your obligations and monetary commitments like a home loan or lease, and some other obligations. At the point when you characterize leftover or automated revenue as far as bringing in cash consistently because of stocks, eminences, or rental payments, it is not difficult to perceive how the two terms are likewise spellbinding. Recurring, automated revenue versus leftover pay and how they are characterized rely upon the conditions of an individual or organization.

The Reality

Uninvolved and leftover pay are two distinct ideas. Lingering pay is what you have after you take care of your bills, and it tends to be used to help a recurring source of income. A type of automated revenue, such as procuring profits on stocks or leasing a get-away property might cost you forthright however the thought behind recurring, automated revenue is that it permits you to bring in cash while you set forth next to no energy or time. When a recurring source of income creates a gain, you can utilize any leftover pay to develop the automated source of income or foster another one. Making an interest in a recurring, automated revenue try can be valuable on the off chance that you can manage the cost of the beginning up costs.