Could Texas finally slip out of the recession?

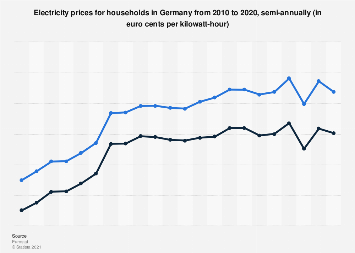

TXU Energy, a leading energy retailer in North Texas, announced on Wednesday that it is reducing its prices for clients. TXU Energy spokeswoman Sophia Stoller said TXU energy rates are 15.9 pennies per kilowatt-hour using 1,000 kWh per month. Costs will generally be less than 7%, although some will fall as a share to 15%.

The second-largest energy store in Texas, Odessa Energy Rates , based in Houston, is taking place near the repairs in May and June. They reduce their costs by a maximum of 20%.

In any case, despite these discounts, clients can also explore price reductions at this point by scanning a good game plan for their needs.

ConocoPhillips found that they lost 76% of their benefits. They were the resulting critical oil in reporting relative disasters in two days. They said that only recently have the cost of gas for the winter and the devastating effects of refining legitimized their second defeat in the area. Garance Financial Group Inc., the second-largest public bank in Texas, said it would consider a downturn after the FICO rating collapsed and downgraded without investing in capital. The inventory, which aims to remain interesting as the partner regions remain exciting, shows that the financial group has something like a fundraiser to recapitalize capacity. The adoption of Guaranty Financial Group is a bomb that will make it the most important American bank that collapsed in 2009. If 64 banks are under siege this year, seven will recover by Friday. The guarantor does not expect to raise enough money to comply with the April request to close everything from the office of the public wrecker to the driver. Currency-related growth in the Dallas Feds area, which includes Texas and parts of Louisiana and New Mexico, “remained most predictable during the limited period of June and early July.” The description of the money released on Wednesday from the Federal Reserve confirms that most individuals in 12 local federations began to shake in the fall or the region began to adjust, even as it expanded. However, the monetary framework is really sensitive, the reality remains that some Fed districts have strange effects at the beginning of the adjustment. These indicators express the belief that this decline may be an even worse attraction very shortly.

The labour market is tighter than in Texas

While labour markets are focused on Texas, the situation in the United States is undoubtedly difficult. Nine per cent in August and a group of workers reached an unnecessarily three-year pulse a year. The United States. Staff selection reduced to 1. 4% salary. It will often increase if employees have a more comfortable view of their potential outcome within the compositional centre; the high stop salary reflects the modest diversity of open trading doors trusted by professionals and a fair labour market.

This growth is higher in Texas than in the United States. Think about a few parts and move on to the causes. Nearly 3% of national retirement costs, increased at the same time, following previous periods of work comfort (such as 2017-18), while U.S. Pat. The fee is at a very high level. Recommends that the local employment centre does not quickly determine the reasons why U.S. Pat. It is often said that this can be detrimental to progress very shortly.